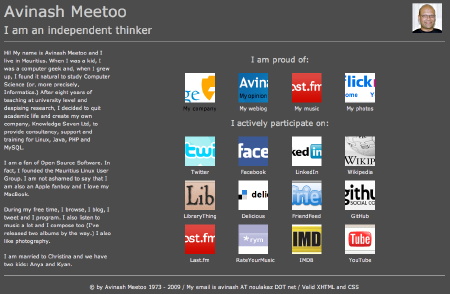

I am happy to announce the official launching of

As you can see, I have bought the meetoo.name domain (and .name is really a top-level domain like .com or .net!) I spent a few days thinking about what to host there, discussing with some people on Twitter (thanks Saajid!) and finally come up with what you can see above.

At first sight, the webpage looks simple but, in fact, making it has allowed me to learn a lot of new tricks. For example, the XHTML is fully semantic (look at the source to understand what I mean.) Layout is entirely done by CSS courtesy of a framework called Blueprint. And I’ve used Javascript to modify the targets of the images as strict XHTML does not support the target attribute. Furthermore, I’ve used powerful caching strategies which mean that all the images, scripts and CSS files are only downloaded once on the client no matter how many times the page is accessed. And the result is that the page is quick to load and is valid XHTML and valid CSS.

Naturally, clicking on the various images will send you to the various websites and social networking sites I like. Have fun exploring